At the heart of family business success is a governance process that evolves and adapts to the changing dynamics of the family, the ownership group and the management team as these groups themselves evolve. As a family business moves from the founder stage where the business is often very “owner centric” to stages where the family and ownership group are more diverse, establishing a well- functioning board of directors is one critical step1. Whether it is creating a board for the first time, or evolving how an existing board operates, implementing good governance can be integral to protecting relationships and the viability of the family’s enterprise. In our experience, board evolution generally proceeds from “paper boards” that never actually meet to family boards composed of family owners to boards with both family owners and non-family independent directors.

We have often observed that although it makes sense to clients that evolving their governance process can be beneficial, rational arguments for change often do not provide sufficient motivation to make needed changes. On the other hand, when emotional pressures associated with uncertainty about upcoming major transition points such as business leadership succession, significant changes to strategy, or evolving from primarily operating owners to primarily non-operating owners, family business leaders are often ready to make governance changes. The motivation to change often comes from recognizing how a well-functioning board of directors can more appropriately shoulder the responsibility for making such major decisions.

Evolving Leadership and Ownership

For example, one family business we know with a group of sixteen family owners spanning three generations has only six owners engaged in significant management roles. While the six operating-owners hold a majority of the ownership, the topic of moving from a “paper board” to a board comprised of family and independent board members surfaced as succession planning got underway. Although the owner-operator group acknowledged how there might be some benefits to the change, their initial reception to the idea was at best lukewarm.

As succession planning progressed, the family CEO expressed his desire to step out of the CEO role in three years. The ownership group began to visualize the true magnitude of and uncertainty associated with their upcoming decisions when a concrete time frame was established by the CEO. Adding more emotions to the situation was the fact that the ownership group composition was going to change from majority operating-owners to majority non-operating-owners. It was at this point that the ownership group started to envision how pressure on family relationships and those working in the business could be relieved by having a decision-making process which included more independence and objectivity.

Critical Questions for Continuity

This family of business owners had started with succession planning: “Who will be the next CEO?” But they soon realized that real success would be found by answering questions such as “What will be the process for making a decision about who will be the next CEO?” “We have never had a non-family CEO, what if there are no family members qualified to be the next CEO?” “How will decisions be made in the future when a majority of the ownership is not working in the business?” “Our non-family executives have had a great deal of confidence in our current family CEO, how do we best perpetuate that confidence?” As the ownership group visualized the upside of a board of directors with independent directors, emotional pressure began to subside, the motivation for change kicked in and they began the process of evolving their governance process.

The most important questions family business owners face, as they seek continuity through generations, are: How will we go on together? How will we make decisions together? Who will guide us? The answer is to develop good governance processes. As each generation succeeds and the ownership group grows the need to assure all owners that their mutual capital is being deployed in the best interest of all also grows. Family harmony and business continuity depend upon trust in the way decisions are made, even if the outcome can’t please everyone. Trust cannot be assumed, it must be built into the very structure of the organization through formal governance. A functioning board of directors and other elements of good governance practices are necessary:

- When the person responsible for business operations is not the sole owner.

- When other members of a family have ownership but no control over the business operations.

- When ownership is spread across a large group of shareholders in increasingly smaller amounts/percentages.

- To assure non-employed owners that employed owners are being compensated fairly.

What Boards Can Provide for Private Companies

Depending upon the legal structure of an organization it may or may not be required to have a board of directors. While “paper boards” may fulfill legal requirements, they fall far short of providing the true advantages a board with independent members should yield: Honest, objective opinions from business experts with no agenda beyond providing the best advice possible.

- Self-discipline and accountability to all owners

- Strategic thinking and counsel to management and owners

- Insights into key issues from inside and outside your industry

- Challenging provocative questions to help management

- Creative thinking from outside the immediate experience of management

- Valuable stakeholder relations (owners, employees, bankers, etc.)

Are Fiduciary Boards Best?

In a word, yes! But it is important to understand that all officers of a company and board members, family, management, or independent, have a fiduciary duty to all owners of the business. Fiduciary duty is the highest standard of care and is designed to protect the rights of all owners both majority and minority. The primary responsibilities of someone in a fiduciary position are generally characterized as the duties of care, loyalty, good faith, confidentiality, prudence, and disclosure. If this makes you wonder if your position of leadership in your family business carries fiduciary duty it probably does if any of these describe your role:

- If you are not the sole proprietor of your business.

- If you are only one of the heirs to shares of your business.

- If you have transferred (sold or gifted) shares to your heirs.

- If you have a minority partner/investor.

- If you have an employee stock ownership plan.

- If you are the trustee for shares held in trust for someone.

When everyone in a position of ownership, management or governance in a family business understands the fiduciary role of those making decisions about the business the result should be greater trust throughout the system. Minority owners become better owners because they have more knowledge and information. Beneficiaries of trusts understand where their benefits come from and what it takes to sustain them long-term. Partners, minority investors, bankers and creditors all have proper understanding of how their interests are served.

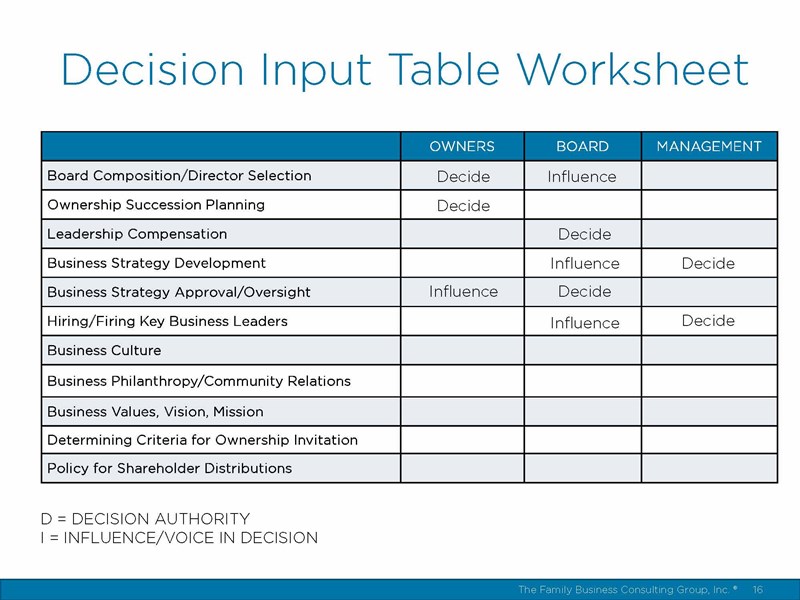

Will a Board of Directors Take Over Our Company?

The most direct answer is no, you are still the owners of your business and you, collectively, have all the rights of owners. While most states give certain powers to the directors of a corporation, the statute generally contains language to the effect of “except those powers retained by the owners”. Therefore, it is important to give careful thought to what decision making powers you want to assign to the board and to management. Although it is tempting for a sole proprietor to think they make all decisions, the reality is that as a business grows beyond the initial start-up stage it is impossible for any one person to make all decisions. Capable and talented managers at many levels need to be empowered to make appropriate decisions to do their job well. That is also true for a board. If these people who have accepted the duties of a fiduciary are to provide the advantages we have already discussed, they need to be able to make decisions accordingly. We urge our clients to spend time coming to an agreement regarding who (management, board, or owners) has decision making power in which areas and who should provide input to decisions. The following worksheet (Table 1) is often helpful in understanding the types of decisions to be made and where the authority to make decisions is most appropriate.

Table 1

Conclusion

Success in both business and family always brings the need for change. When ownership groups begin to contemplate the need to plan for important transitions in the ownership and leadership of their enterprise, they should also give consideration to good governance practices. Although the concept of a functioning board of directors may seem like needless bureaucracy to operating-owners, it is critical to maintaining trust and harmony in future ownership groups, particularly when a many of the owners are not actively leading their business. But as important as trust and harmony are in any business, the benefits of a well-structured board with independent directors goes much farther to provide innovative thinking and broad-based experience benefitting both the family and their enterprise.

1 Another critical step is implementing family governance practices. See “Getting Started with Family Governance” for more information.

Additional Resources:

Webinar Recording: Forming an Effective Family Business Board: Advisory vs. Fiduciary

Worksheet: Decision Input Table